By: Sebastian Mariz, CEO of Influence Spain

.

In his appearance before the Parliament on the 13th of May, during the monthly Government control session, Pedro Sánchez reiterated his firm commitment to maintaining political stability until the end of the legislature in December 2023. He also indicated that his Government remains fully committed to renewable energies, and measures to curb greenhouse emissions.

The decision taken in May by the European Commission, delaying implementation of the EU fiscal stability rules until the end of 2023, will help Sanchez keep his word, and to focus on positioning himself and the Socialist Party as the champions of the left in Spain, and in the run up to the Andalucian elections to be held on the 19th of June. The incumbent, conservative Popular Party is expected to win.

Andalucian elections

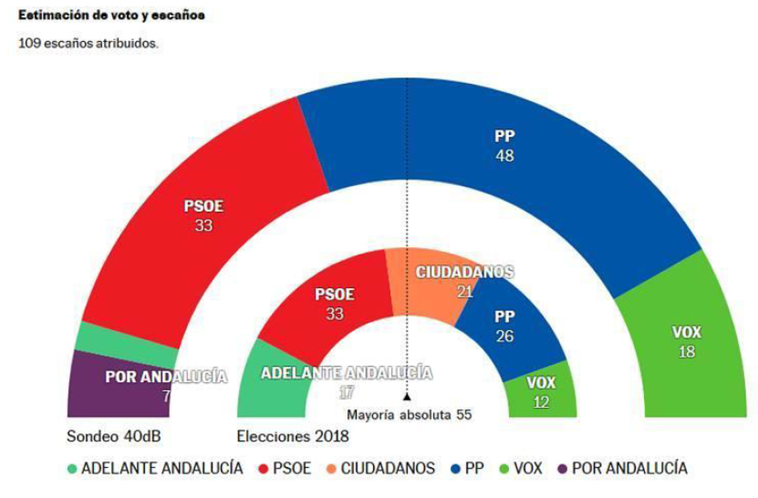

The latest polls in Andalucía give the Popular Party 48 seats in a parliament of 109 seats, and only 7 seats shy of the absolute majority needed to govern on their own. The far-right Vox party would win 18 seats, giving the right a comfortable lead in the regional parliament and would allow the incumbent, Juanma Moreno, to retain his office and to rule with a minority government and parliamentary support from Vox. The liberal Ciudadanos Party, the junior partner in the current Government, is not expected to retain any seats in the regional Parliament, or two to three at best.

If these results were to be confirmed they would reflect support from a majority of voters for the way policy has been managed under Junama Moreno, but also the growing discontent in the coalition government of Pedro Sánchez, and a lack of trust in the candidates proposed by the socialists and the communists.

New budget for 2023

Comfortable in the knowledge that he has a year and a half left to govern, Sánchez has instructed his Finance Minister to initiate informal negotiations with the junior partner in the Government on an annual budget proposal for the public administration in 2023. This budget proposal will need to be approved by a majority in Parliament in November, but is not crucial for Sánchez to remain in power until the end of the legislature. If he fails to pass the proposed budget, he can roll over the current one for another year.

Sánchez’s objective in tabling a draft budget, is to publicly frame all of the other political groups in the Parliament in the run up to the general elections at the end of next year, and the municipal and regional elections to be held in May 2023. By including proposals in the budget aimed at protecting vulnerable individuals and households, such as more intervention on the gas and petrol markets, more rent price controls, extended maternity and paternity leave, and reduced VAT on certain consumer goods such as feminine hygiene products, those political groups rejecting the budget, will be forced to propose alternatives and to explain to voters why they are voting against more State aid and support to vulnerable households and consumers in a moment of high inflation and economic stagnation.

Positioning himself and his political group as the protector of the vulnerable and of State aid in a moment of economic hardship, Sánchez hopes regain voter support. According to the latest national polls published by private polling companies, either the socialists and the conservatives are tied, or the conservatives have gained a slight advantage over the socialists. In one of the polls, if elections were held today, the conservative Popular Party, lead by Núñez Feijóo, would win 26.9% of the votes, or 109 seats in the parliament and the socialists, 26.3% of the votes, or 104 seats. With Vox increasing its representation to 63 seats, and the communists dropping 11 seats to 24, the right would only need four more seats to be able to form a coalition government, whereas the left-wing groups wouldn’t be able to muster sufficient seats to create a left-wing coalition government, and with Sánchez repeating as Prime Minister.

The polls reflect voter discontent over the Government’s handling of the economic crisis and in particular high inflation, and fatigue over regular conflicts between the coalition partners and with the smaller regionalist and radical parties, in particular the Catalan ones, in the national Parliament.

Davos and foreign direct investment

On the economic front, Sánchez wants to attract more foreign direct investment to bolster economic growth, while increasing the Government’s control over foreign direct investment in strategic sectors, and in particular in energy and renewables. The ministries of Finance, Industry and Environment are currently debating which sectors will be considered strategic and the threshold at which Government authorization will be required before making an investment. The Finance and Environment ministers are in favor of low thresholds of 5% market share, whereas the Industry Minister favors higher thresholds of 15% market share, and fewer sectors being considered strategic. She is more open to foreign direct investment than her counterparts in Finance and Environment.

At the World Economic Forum in Davos last week, Sánchez met with CEOs of those companies considered strategic for the Government’s economic priorities in terms of energy, digitalization and industrial policy. Companies such as Intel, Qualcomm and Cisco met with Sánchez to discuss his 11 billion euros plan to convert Spain into a new global hub of chip production. Sánchez also met with large investment groups such as Norwegian Statkraft, to discuss transforming Spain, in the short term, into the new gas supplier of Europe, through completion of a new gas interconnection with France and new gas supplies from Qatar, and in the mid-term into one of the continent’s main green hydrogen suppliers, using the new gas infrastructure to pipe hydrogen to the rest of Europe.

Housing bubble

Record high home rental prices, and the fear of a new housing bubble are making news. Total sales of new and second hand housing registered in March, haven’t been seen since 2007, and a total of 482,066 houses have changed hands over the past 12 months. According to data published by real estate agencies, domestic demand for buying a house has jumped from 40% to 50%, while demand for rental housing has dropped from 50% to 38%. The lack of new housing start-ups due to supply shortages caused by the Ukrainian war, and anxious consumer demand driven by fear of higher interest rates, continues to push prices up to levels not seen since the housing bubble of 2002 to 2008, but still 9% below the records set in 2007. Despite declining demand for rental housing, and State intervention on the rental market in places such as Barcelona, rental prices also continue to register record prices in many of Spain’s cities, with Barcelona and Madrid registering the largest hikes and highest rental prices per square meter.

Tourism growth and restrictions

Tourism continues to show robust growth, with tourists returning en masse to popular destinations such as the Balearic Islands, Barcelona and the Costa del Sol, but also to new destinations such as Madrid. Growth in tourism is spurred largely by tourist fears over the Ukranian war and a possible spillover of instability into other Eastern European countries, but also by competitive prices in hotel rooms and plane tickets in Spain. The government’s objective is to reach 80% of the number of tourists who visited Spain in 2019, by the end of the year. The regional and municipal elections of May 2023, may, however, hinder reaching this objective, with communist and environmentalist political groups in places such as Barcelona, Palma de Mallorca and Valencia threatening to adopt local legislation restricting tourist visits, the number of hotel beds on the market, or the arrival of cruise ships to their ports.

.

Every month, Influence Spain provides a look at Spanish current affairs. For more information, join our social media profiles on Twitter and LinkedIn.